In 2024, macroeconomic conditions improved on multiple fronts. On the one hand, economic growth strengthened due to a recovery in domestic demand as a result of lower interest rates, which went along with lower inflation levels. At the same time, although the Colombian peso depreciated, this behavior favored exports and a reduction in the current account deficit thanks to remittances, which in turn increased Colombian household income and consumption.

Consequently, the Company achieved growth due to the acceleration of some products and services: it closed with 24.4 million total customers (-2.9 % year-over-year). In contract, the figure fell by -296 thousand customers due to the acidity of the market with the dynamics of mobile service offers, and the increase in churn due to portability, achieving 5.1 million customers. In the prepaid mobile business, there was also a decrease of -2.3 % compared to the previous year, reaching a total of 15.6 million customers.

In the fixed business, the Fiber Optic expansion strategy has achieved the expected results, standing out for the repositioning of the offers leveraged on the increase of the navigation speed up to 900 megabytes, strengthening its competitiveness in the market. Likewise, during 2024, the Company accelerated the deployment of its fiber network, reaching more than 5.9 million homes passed and close to 1.5 million connected customers, which represents a 22 % growth in the customer base compared to the previous year. These advances position Movistar as a leader in fiber optic service in Colombia, not only for its number of customers, but also for its coverage in 92 municipalities, the most extensive in the country.

As for pay TV, Movistar closed the year with more than 848 thousand accesses, of which 808 thousand correspond to IPTV, a segment that experienced a year-on-year growth of 11.1 %, partially offsetting the -60 % drop in Direct TV over Satellite (DTH) accesses, which closed with 40,213 accesses in 2024.

The Company achieved operating revenues of COP 6.67 trillion in 2024, reflecting a year-on-year decrease of 6 % with respect to the previous year, maintaining a moderate performance, mainly driven by prepaid services and with offers that allow satisfying communication and connectivity needs, mitigating the regulatory effect that affects the portability of users between operators and the decrease in mobile interconnection rates determined by the CRC. Traditional fixed services represent strong growth due to the rapid transformation to fiber to the home, reaching 96 % of fixed broadband accesses connected to this technology.

The sale of mobile terminals has decreased due to lower market growth in this line of business, high financing rates and a macroeconomic environment of low growth that has slowed the commercial dynamics in this product.

In other operating income, the sale of copper material was a growth driver as a result of the transition from cabling to fiber optics.

Operating expenses decreased year-over-year, mainly due to lower sales of mobile equipment impacted by the current economic conditions and lower direct costs associated with lower commercial activity of digital services in the corporate segment, in addition to efficiencies and optimization of the use of resources such as: renegotiation of contracts with allies, commercial costs with more efficient channels, optimization of inventory availability and regulatory aspects with impact on interconnection and roaming rates, on the other hand, increased costs of equipment in the customer’s home and fiber optic connectivity service.

During 2024, the Company made investments and executed CAPEX of approximately COP 503 billion. These investments included the development and deployment of infrastructure to support both mobile and fixed communications, promoting the expansion and quality of connectivity in the country. In addition, resources were allocated to strategic projects for the Wholesale and Enterprise segment, providing advanced technological solutions for its corporate customers.

Movistar also prioritized the strengthening of its digital platforms and customer service systems, in order to optimize operational efficiency and provide a more agile and personalized experience to users.

EBITDA–an indicator that measures performance and operating income before depreciation and amortization– reached COP 1.54 trillion, reflecting a slight decrease of 0.6 % compared to the previous year. Despite this adjustment, the result during 2024 was driven by the performance of fiber optic and prepaid services revenues, as well as by the sale of copper material, which contributed to mitigate the pressure on profitability. In addition, the company implemented cost optimization strategies and captured efficiencies in operating expenses, which allowed it to sustain an EBITDA margin of 23.2 %.

Sources

and Uses

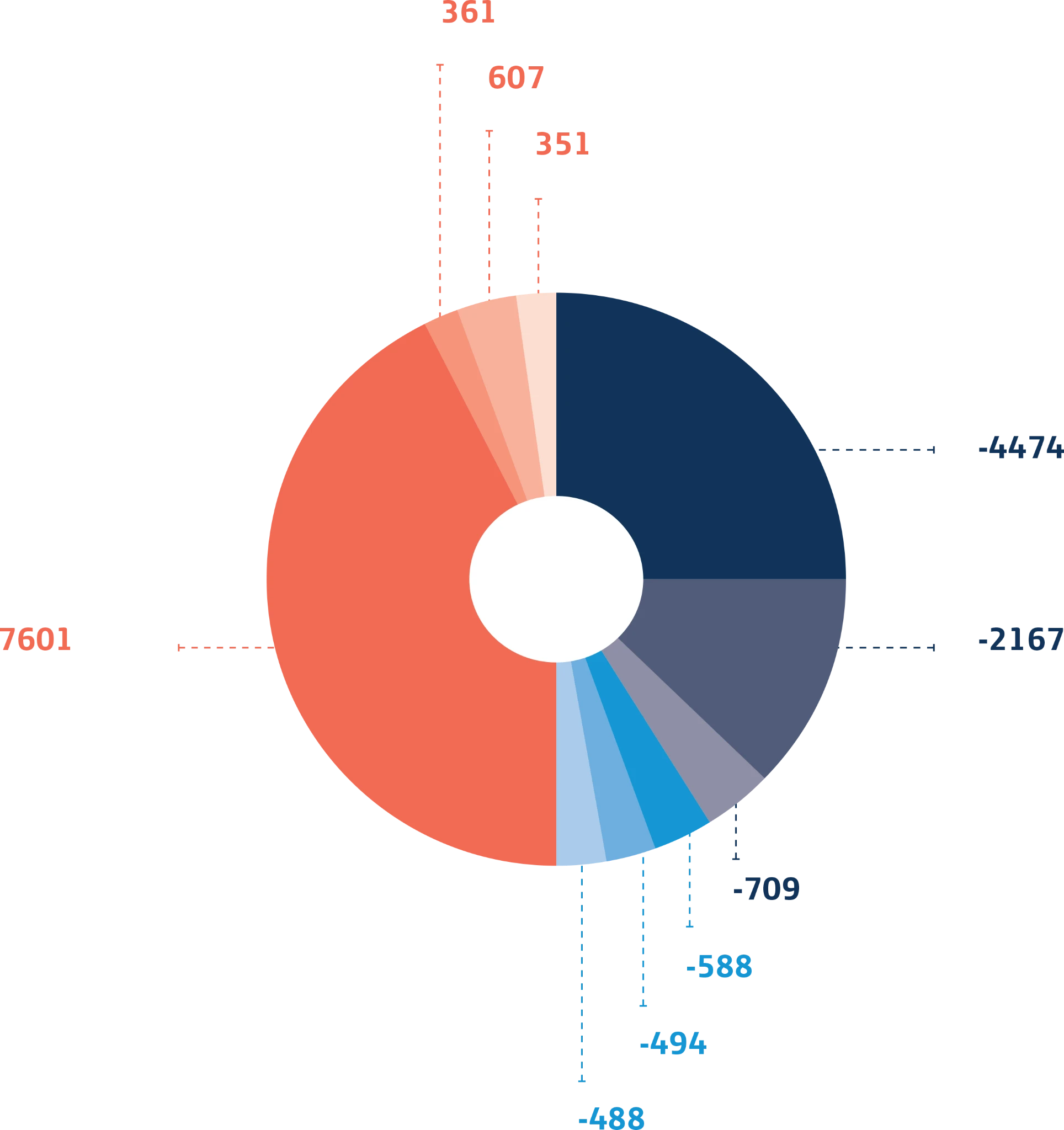

Cash flow shows sources and uses totaling COP 8.9 billion.

In 2024, uses included COP 4.47 trillion for payments to suppliers, COP 2.16 trillion for payments to financial creditors, COP 709 billion for payments to public administrations, COP 488 billion in Investments, COP 588 billion for employee payroll payments and COP 494 billion for payments to Group companies.

COP 8.920 MM

Usos

- Suppliers

- Financial creditors

- Public administrations

- Employees

- Investors

- Payments to Group companies

Fuentes

- Customers

- Initial cash

- New debt

- Other sources

Figures in COP billions

Sustainable

Financing

Since the implementation of the model, the Company has negotiated close to COP 1.6 trillion in debt with financial institutions through loans linked to sustainability indicators. In 2024, it closed agreements with Bank of Nova Scotia and Itaú and maintained commitments with Bancolombia and BBVA to comply with indicators: women’s leadership, cybersecurity training, energy efficiency and emissions reduction scopes 1 and 2.

In 2024, the Limited Assurance process was carried out, and following PwC reports, the banks confirmed compliance with the 2023 targets, strengthening confidence and commitment to sustainability.